Transferring a land title in the Philippines involves several steps, including the preparation of documents, tax payments, and registration with various government agencies. Here’s a general guide:

1. Prepare the Requirements:

- Deed of Sale or Deed of Conveyance or Extrajudicial Settlement of Estate or self adjudication or Deed of Donation (notarized)

- acknowledgement receipt or Official Receipt of the Notary Public for the Notarization of Deed.

- Identification documents (Gov’t Issued ID’s) of all parties involved (seller and buyer) with specimen signatures.

- Verified Taxpayer Identification Number (TIN)

- Certified True Copy of the Original Land Title

- Owner’s Duplicate Copy of the Title (TCT or CCT)

- Certified true copy of the Latest Tax Declaration of Land, Property Holdings if any, or Certificate of no occupancy.

- Tax Clearance for both Land and property

- Official Receipt of Real Estate property tax and Association Dues payment.

- Clearance from the Homeowners Association or Condominium Association

- Marriage certificate (if Married), Birth Certificate (Heirs), Death Certificate if (Estate) and Certificate of no Marriage(Single)

- Pictures of the property, and Location Map or Vicinity map of the Property to be transferred.

- Notarized Special Power of Attorney or Authorization Letter to Process the transfer. (if by representative)

- Cancellation or Release of Mortgage, if applicable.

- Board Resolution and Secretary Certificate, if applicable (for Corporation)

- Certification of Philippine Consulate , if applicable.

2. Pay Capital Gains Tax and Documentary Stamp Tax:

- This requires submitting documents to the Bureau of Internal Revenue (BIR) for computation and payment.

- Notarized Deed of Absolute Sale/ Documents of transfer

- acknowledgement receipt or Official Receipt of the Notary Public for the Notarization of Deed.

- Certified true copy of the latest Tax Declaration for the Land

- Certified true copy of Transfer Certificate of Title (TCT)/Condominium Certificate of Title (CCT)/Original Certificate of Title(OCT)

- Sworn Declaration of No Improvement by at least one(1) of the transferees or Certificate of No Improvement issued by the Assessor’s Office, if applicable.

- Special power of attorney, if by representative.

- Certification of Philippine Consulate , if applicable.

- Cancellation/Release of Mortgage, if applicable.

- Tin verification for both Buyers and Seller.

- Identification documents (Gov’t Issued ID’s) of all parties involved (seller and buyer) with specimen signatures

- Payment must be made to the local partner bank of the BIR RDO

- Needed Forms in Payment BIR 1706, BIR 2000OT, BIR 0605 (3 Copies)

- Computation Sheet

- Board Resolution and Secretary Certificate, if applicable (for Corporation)

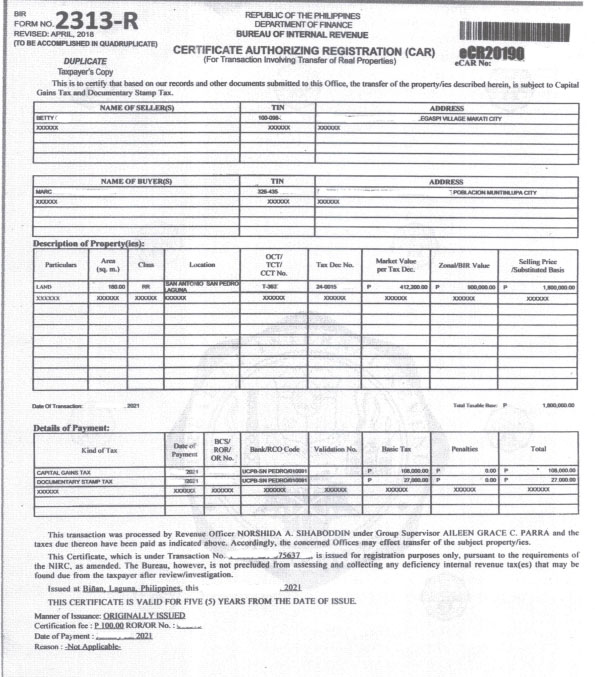

3. Obtain a Certificate Authorizing Registration (ECAR):

- After paying taxes, the BIR will issue a CAR authorizing the transfer.

4. Register the Transfer with the Local Treasurer’s Office:

- Submit the CAR for verification and payment of Transfer Tax fees.

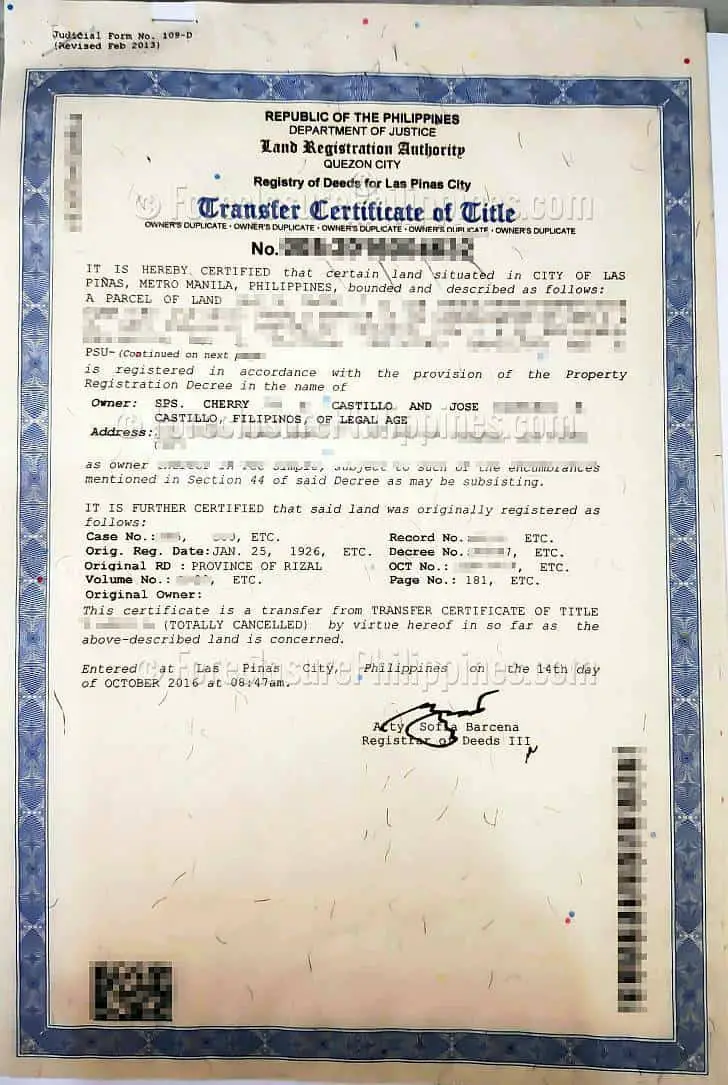

5. Register the Transfer with the Registry of Deeds(lra.gov.ph):

- Submit all required documents, including the CAR, for processing and issuance of a new title under the buyer’s name.

- Deed of Sale or Deed of Conveyance or Extrajudicial Settlement of Estate or self adjudication or Deed of Donation (notarized)

- acknowledgement receipt or Official Receipt of the Notary Public for the Notarization of Deed.

- Identification documents (Gov’t Issued ID’s) of all parties involved (seller and buyer) with specimen signatures.

- Certified True Copy of the Original Land Title

- Owner’s Duplicate Copy of the Title (TCT or CCT)

- ECAR from the BIR

- Certified true copy of the Latest Tax Declaration of Land, Property Holdings if any, or Certificate of no occupancy.

- Tax Clearance for both Land and property

- Official Receipt of Real Estate property tax and Association Dues payment.

- Clearance from the Homeowners Association or Condominium Association

- Marriage certificate (if Married), Birth Certificate (Heirs), Death Certificate if (Estate) and Certificate of no Marriage(Single)

- Pictures of the property, and Location Map or Vicinity map of the Property to be transferred.

- Notarized Special Power of Attorney or Authorization Letter to Process the transfer. (if by representative)

- Cancellation or Release of Mortgage, if applicable.

6. Register the Transfer with the Assessors Office:

- Submit the Certified True Copies, and other requirement for processing and issuance of a new Tax Declaration under the buyer’s name.

- Certified Copy of the New Land Title from Registry of Deeds

- Certified Copy of the Old Title

- Deed of Sale or Deed of Conveyance or Extrajudicial Settlement of Estate or self adjudication or Deed of Donation (notarized)

- Copy of ECAR from the BIR

- Copy of Certified true copy of the Latest Tax Declaration of Land, Property Holdings if any, or Certificate of no occupancy.

- Copy of Tax Clearance for both Land and property

- Copy of the Official Receipt of Real Estate property tax and Association Dues payment.

Additional Tips:

- Consider seeking assistance from a lawyer or a licensed Real Estate Broker to ensure a smooth and legal transfer process. you can visit us at www.rltypro.com.ph

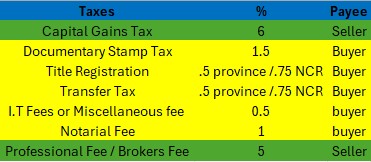

- List of possible Fees: