PH Real Estate – Understanding Property Titles and Legal Documents

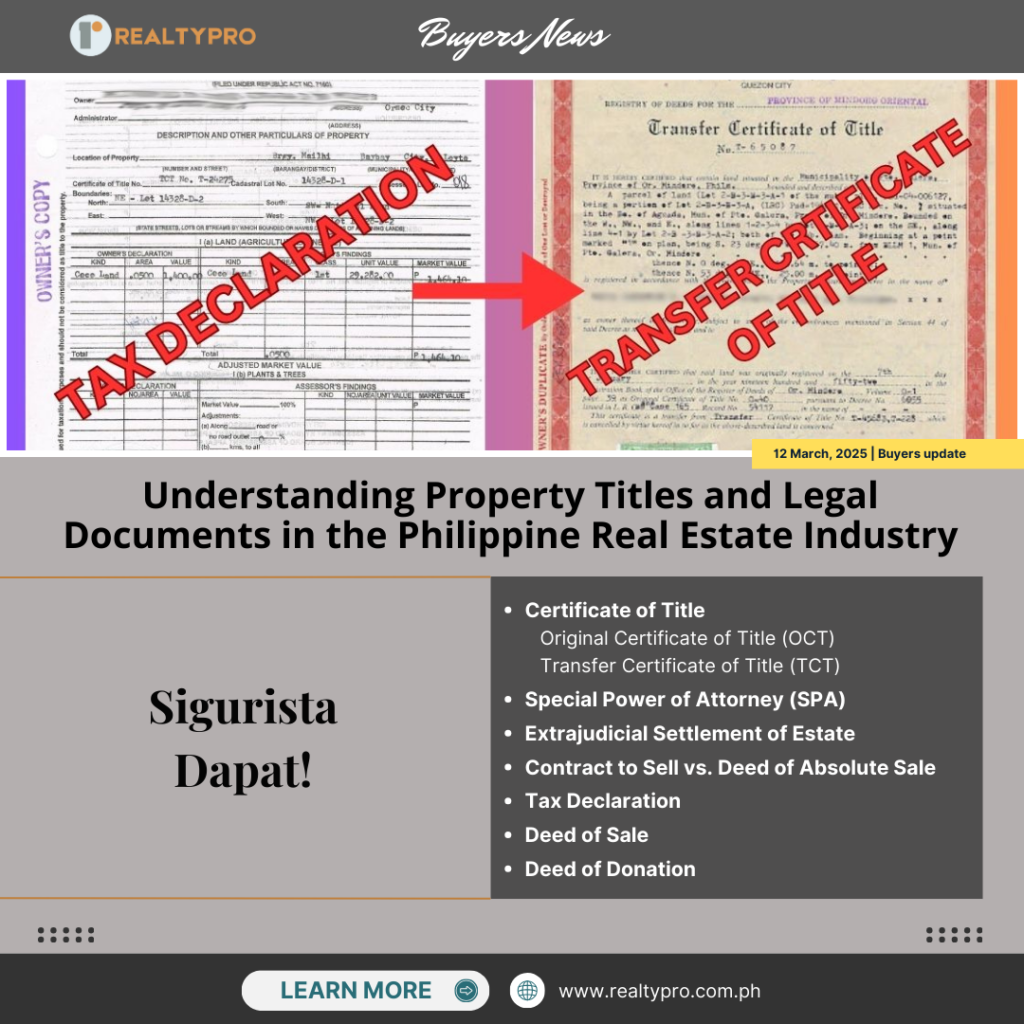

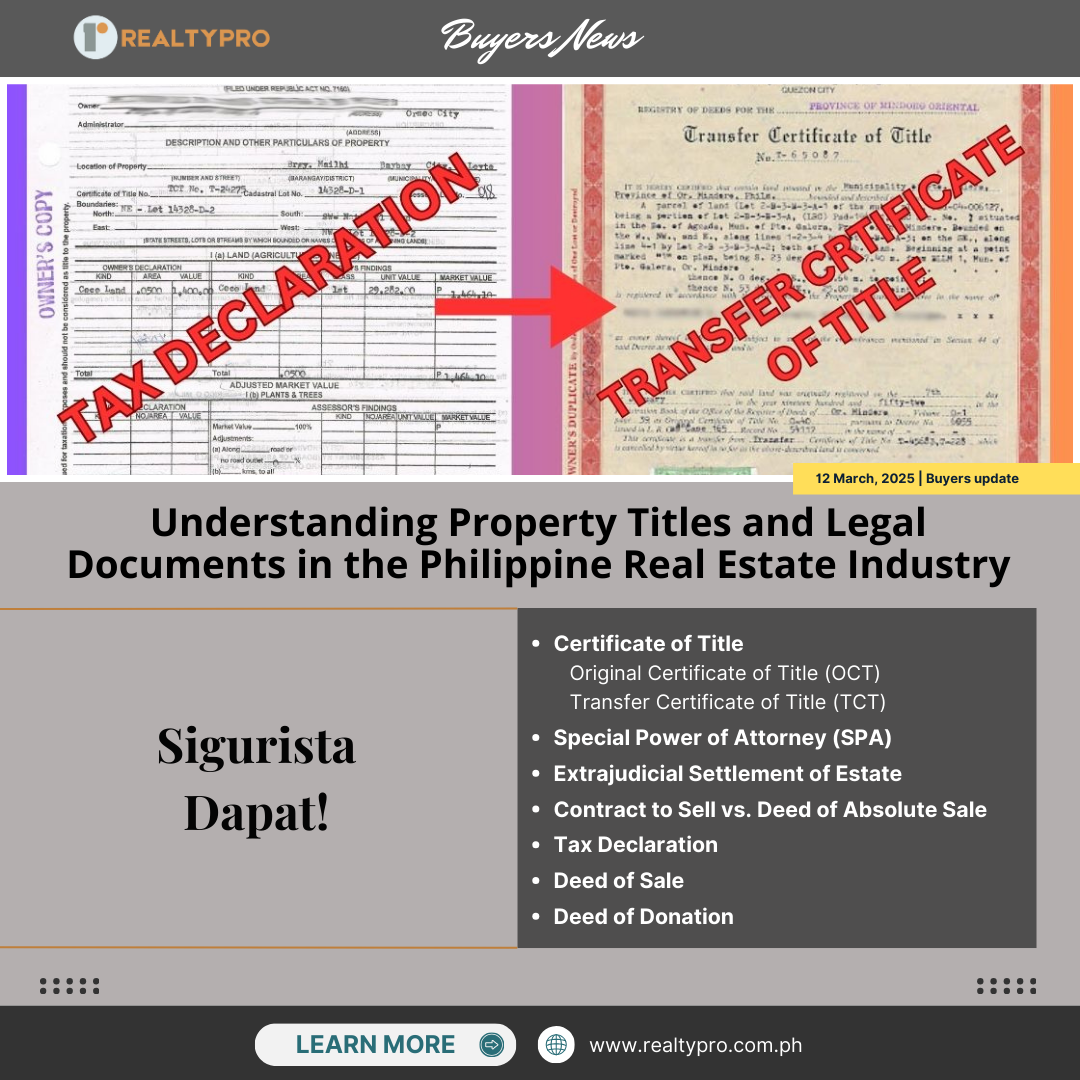

Understanding Property Titles and Legal Documents in Philippine Real Estate

Buying or investing in real estate is a big step, and in the Philippines, understanding property titles and legal documents is essential. Whether you’re a first-time homebuyer, a seasoned investor, or inheriting property, knowing these documents can save you from headaches and legal troubles.

Let’s dive into the essentials of property titles and legal paperwork so you can make informed decisions with confidence!

Certificate of Title: Your Proof of Ownership

One of the most important documents you should check when acquiring property is the Certificate of Title. Issued by the Land Registration Authority (LRA), this document confirms the legal owner of the property. There are two main types:

- Original Certificate of Title (OCT) – Issued for properties registered for the first time under the Torrens system.

- Transfer Certificate of Title (TCT) – Issued when a property changes ownership. The original title is canceled, and a new TCT is registered under the new owner’s name.

✅ Always verify the authenticity of the title at the Registry of Deeds to avoid scams!

Tax Declaration: What You Need to Know

The Tax Declaration is issued by the Assessor’s Office and is used for tax purposes. However, be careful—owning a Tax Declaration does NOT mean you own the property.

The Certificate of Title remains the ultimate proof of ownership.

Deed of Sale: Making the Transfer Official

The Deed of Sale is the official document confirming that a property has been sold from one person to another.

To ensure the transfer is legally binding, it must be notarized and registered at the Registry of Deeds.

Special Power of Attorney (SPA): When You Need Someone to Represent You

If you’re unable to handle a real estate transaction in person, you can authorize someone else to act on your behalf through a Special Power of Attorney (SPA).

This is especially useful if the owner is abroad or unavailable to sign documents.

Deed of Donation: Gifting Property the Right Way

Want to transfer property as a gift? You’ll need a Deed of Donation, which must be notarized and registered.

📌 Depending on the property’s value, a donor’s tax may apply.

Extrajudicial Settlement of Estate: When Property is Inherited

If a property owner passes away without a will, the heirs must file an Extrajudicial Settlement of Estate to legally divide and transfer the property.

This prevents future ownership disputes.

Contract to Sell vs. Deed of Absolute Sale: What’s the Difference?

For pre-selling properties, developers usually provide a Contract to Sell (CTS) instead of a Deed of Absolute Sale.

- Contract to Sell (CTS) – Outlines the payment terms but does not transfer ownership yet.

- Deed of Absolute Sale – Ownership is only transferred once full payment is completed.

Conclusion: Sigurista Dapat!

Kapag bibili o mag-iinvest sa real estate, siguraduhin mong alam mo ang mga legal na dokumentong dapat mong i-check.

❌ Hindi porket may Tax Declaration ka, sa’yo na agad ang lupa o bahay!

✅ Ang pinakaimportanteng dokumento pa rin ay ang Certificate of Title.

Para maiwasan ang hassle at problema, mas mabuting kumonsulta sa isang real estate lawyer o reputable real estate agent.

Tandaan: Sa real estate, “Sigurista dapat!” Mas mabuti nang maging maingat kaysa magsisi sa huli!

With the right knowledge, navigating Philippine real estate transactions becomes easier and safer.

📢 Share this guide with others so they, too, can make informed decisions!

Learn more about – Urban vs. Rural Real Estate: Which is the Better Investment Today?

One Comment