The Importance of AMLC in the Philippine Real Estate Industry

The real estate industry is a key driver of the Philippine economy. However, it is also vulnerable to money laundering and illegal financial activities. To combat this, the Anti-Money Laundering Council (AMLC) plays a vital role in ensuring transparency and legality in real estate transactions, preventing fraudulent activities and financial crimes.

Why is AMLC Important in the Real Estate Sector?

Real estate is a common avenue for money laundering due to the large financial transactions involved. Criminals may use property purchases to disguise illegal funds, making strict compliance measures essential. The AMLC ensures that real estate professionals follow due diligence procedures, verify transactions, and report any suspicious activities.

AMLC Compliance Requirements for Real Estate Professionals

Under Republic Act No. 9160 (Anti-Money Laundering Act of 2001) and its amendments, real estate developers, brokers, and agents are classified as “covered persons” and must comply with AMLC regulations. Their key responsibilities include:

- Customer Due Diligence (CDD): Verifying buyer identities and conducting background checks before transactions.

- Suspicious Transaction Reporting (STR): Reporting any unusual financial activities to AMLC for investigation.

- Record-Keeping: Maintaining transaction records for at least five years to ensure traceability in case of an audit or investigation.

How AMLC Enhances Transparency in Real Estate Transactions

The AMLC not only monitors and enforces compliance but also fosters a trustworthy real estate market. By preventing illicit funds from entering the industry, AMLC protects investors and buyers from engaging in fraudulent dealings unknowingly.

Additionally, AMLC helps prevent artificial inflation of real estate prices caused by illicit money, ensuring a competitive and accessible market for both local and foreign investors.

Consequences of Non-Compliance

Failure to comply with AMLC regulations can lead to severe penalties, including fines, business license revocation, and legal action. Real estate professionals who fail to register with AMLC or report suspicious transactions may face administrative and criminal liability.

Step-by-Step Process for AMLC Certification

For real estate professionals and entities seeking AMLC certification, follow these steps:

- Register with AMLC: Create an account on AMLC’s goAML portal as a covered person or entity.

- Complete the Online Application: Submit required documents such as business registration papers and identification documents.

- Undergo Customer Due Diligence (CDD) Training: Participate in AMLC-mandated training on compliance and reporting.

- Assign a Compliance Officer: Designate a compliance officer responsible for adherence to AMLC regulations.

- Implement an Internal Anti-Money Laundering Program: Develop policies to monitor transactions and detect suspicious activities.

- Submit the Application for Approval: Provide all necessary documentation for AMLC’s review.

- Wait for Certification Approval: AMLC will assess the application and grant certification upon compliance.

- Maintain Compliance: Regularly monitor transactions, update records, and report any suspicious activities to AMLC.

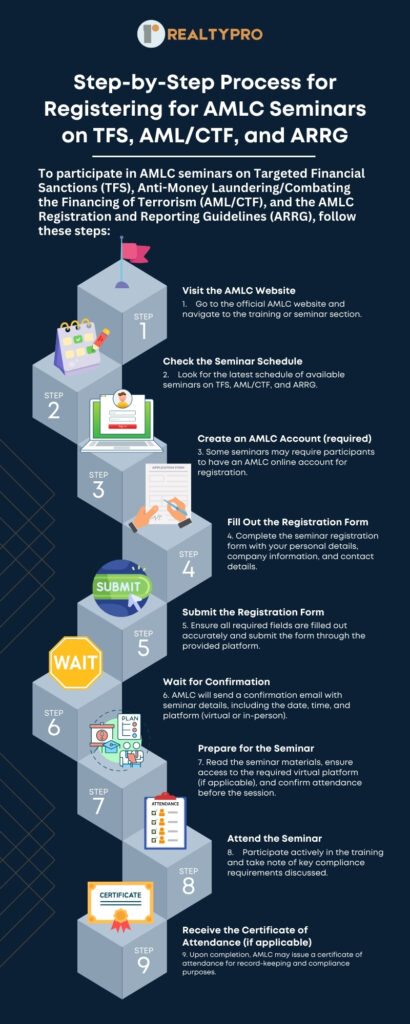

How to Register for AMLC Seminars

To participate in AMLC seminars on Targeted Financial Sanctions (TFS), Anti-Money Laundering/Combating the Financing of Terrorism (AML/CTF), and the AMLC Registration and Reporting Guidelines (ARRG), follow these steps:

- Visit the AMLC Website: Navigate to the training or seminar section.

- Check the Seminar Schedule: Look for upcoming seminars on TFS , AML/CTF, and ARRG.

- Create an AMLC Account (if required): Some seminars may require an AMLC online account.

- Fill Out the Registration Form: Provide your personal and company details.

- Submit the Registration Form: Ensure accuracy before submission.

- Wait for Confirmation: AMLC will send an email with seminar details.

- Prepare for the Seminar: Review materials and confirm your attendance.

- Attend the Seminar: Participate actively and take note of key compliance guidelines.

- Receive the Certificate of Attendance (if applicable): AMLC may issue a certificate for record-keeping and compliance purposes.

Conclusion

The AMLC plays a crucial role in protecting the Philippine real estate industry from financial crimes. By enforcing strict compliance measures, real estate professionals can help create a transparent and secure market for buyers and investors. Adhering to AMLC regulations ensures the industry’s credibility while contributing to national financial stability and security.

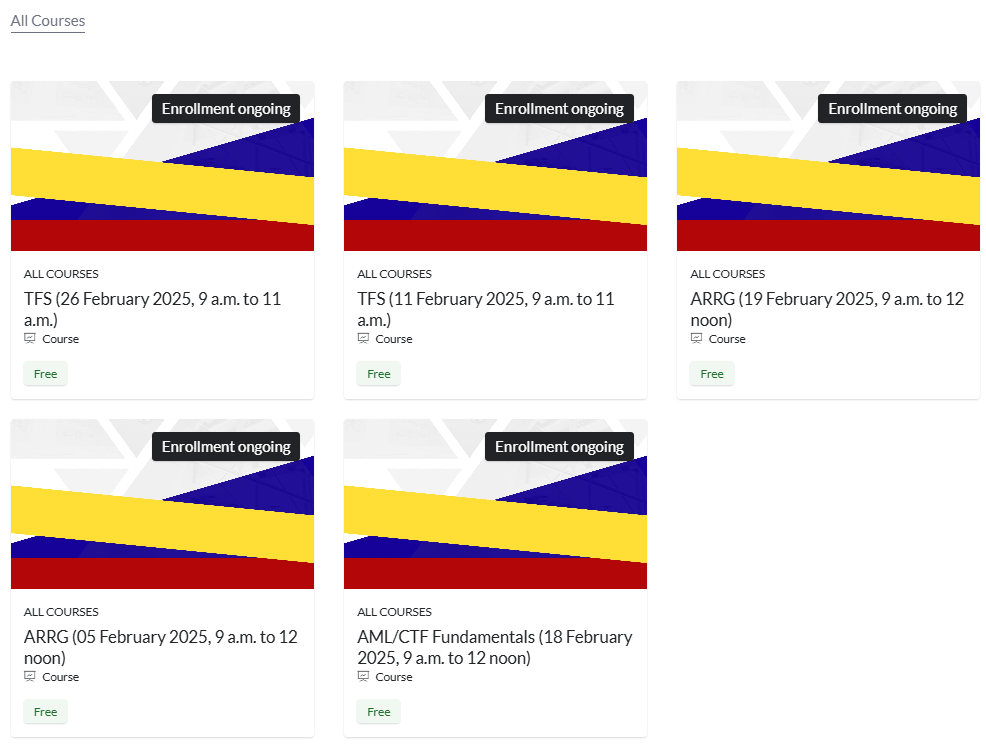

All Courses

ARRG (05 February 2025, 9 a.m. to 12 noon)

TFS (11 February 2025, 9 a.m. to 11 a.m.)

AML/CTF Fundamentals (18 February 2025, 9 a.m. to 12 noon)

ARRG (19 February 2025, 9 a.m. to 12 noon)

TFS (26 February 2025, 9 a.m. to 11 a.m.)

Learn more about – Philippine Real Estate Market in 2025: A Year of Transformation